As we navigate through 2024, the home products industry has seen a significant transformation, reflecting changing consumer priorities, technological advancements, and a growing emphasis on sustainability and smart living. This year, several categories have emerged as trendsetters, offering innovative solutions that cater to the evolving needs and desires of homeowners. From enhancing comfort and convenience to embracing eco-friendly practices, these categories represent the pinnacle of home innovation. Here’s a look at the top trending home product categories of 2024 and an insight into our comprehensive review process.

Leading Home Products Categories of 2024

1. Smart Home Automation

Smart home automation has continued to dominate the market, with products that integrate seamlessly into daily life, offering unprecedented control over home environments. Innovations in this category include advanced smart thermostats, lighting systems, and security devices that not only provide convenience and efficiency but also contribute to energy savings and enhanced security.

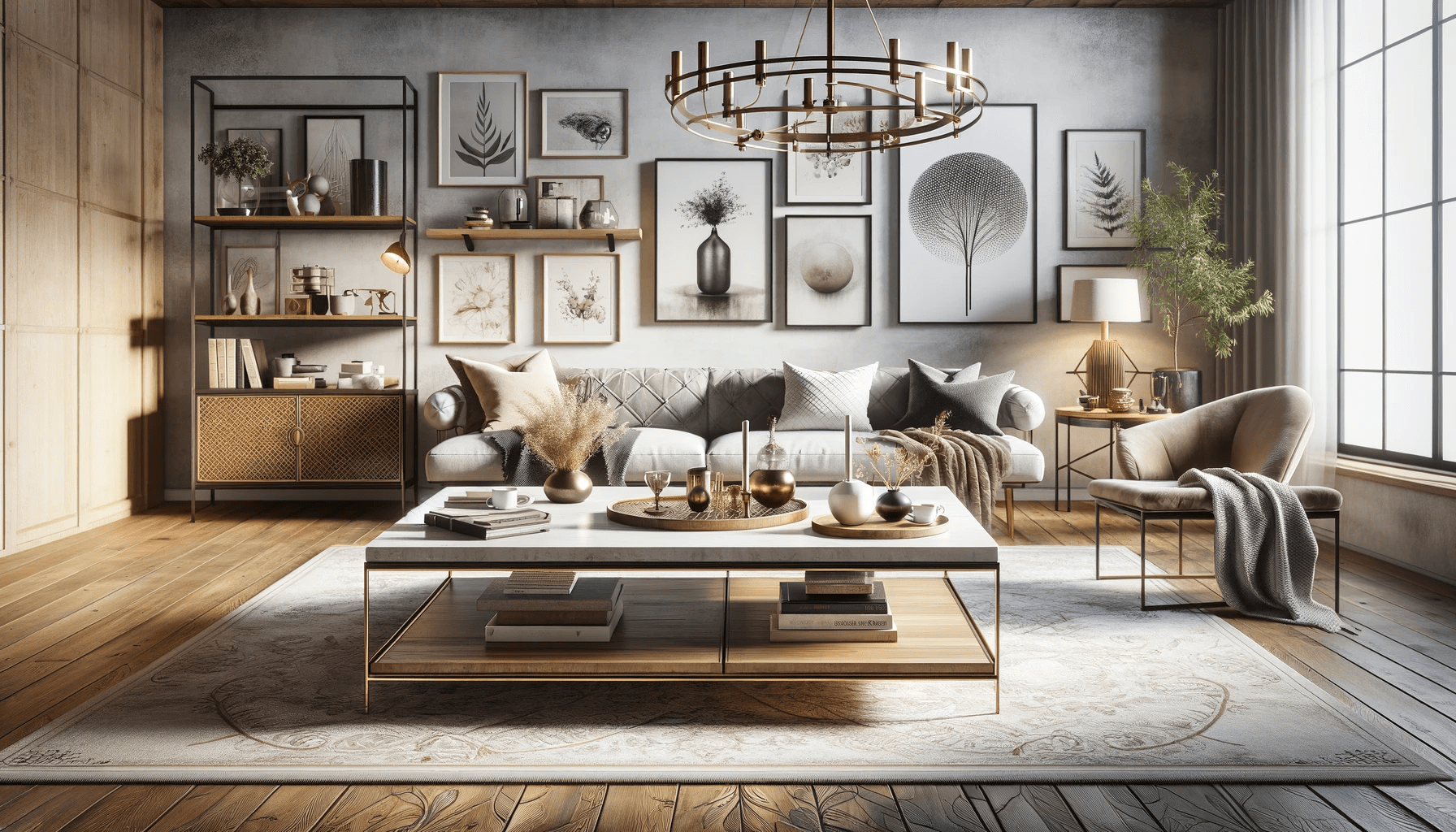

2. Eco-Friendly Home Solutions

Sustainability has taken center stage, with eco-friendly home solutions witnessing a surge in popularity. This category encompasses products made from sustainable materials, energy-efficient appliances, and water-saving fixtures, all designed to minimize environmental impact while maintaining high performance and aesthetic appeal.

3. Home Fitness and Wellness

The home fitness and wellness category has expanded significantly, reflecting a shift towards maintaining health and well-being within the comfort of one’s home. High-tech exercise equipment, ergonomic furniture, and air purification systems cater to a holistic approach to health, blending functionality with design to create conducive wellness spaces.

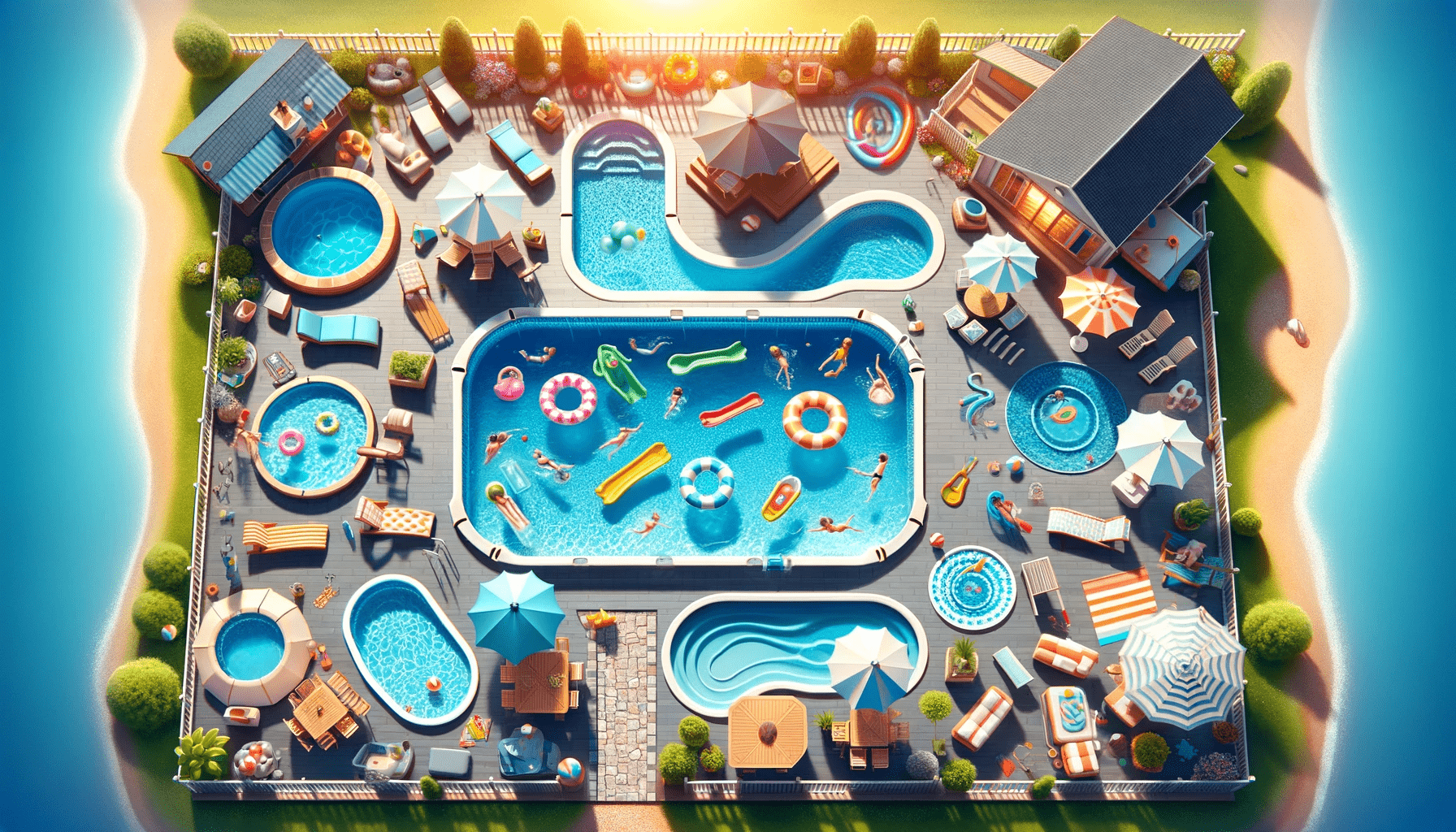

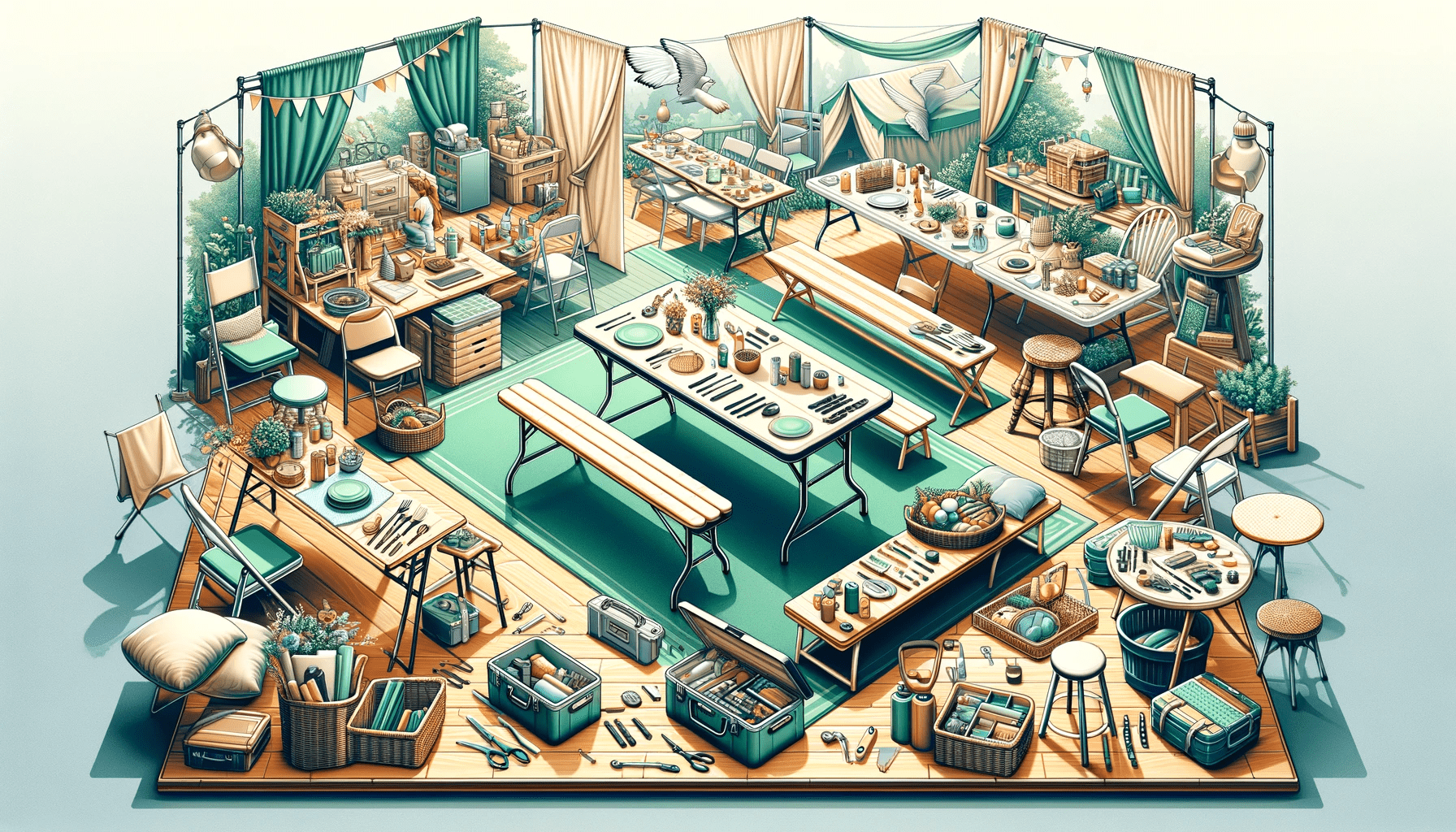

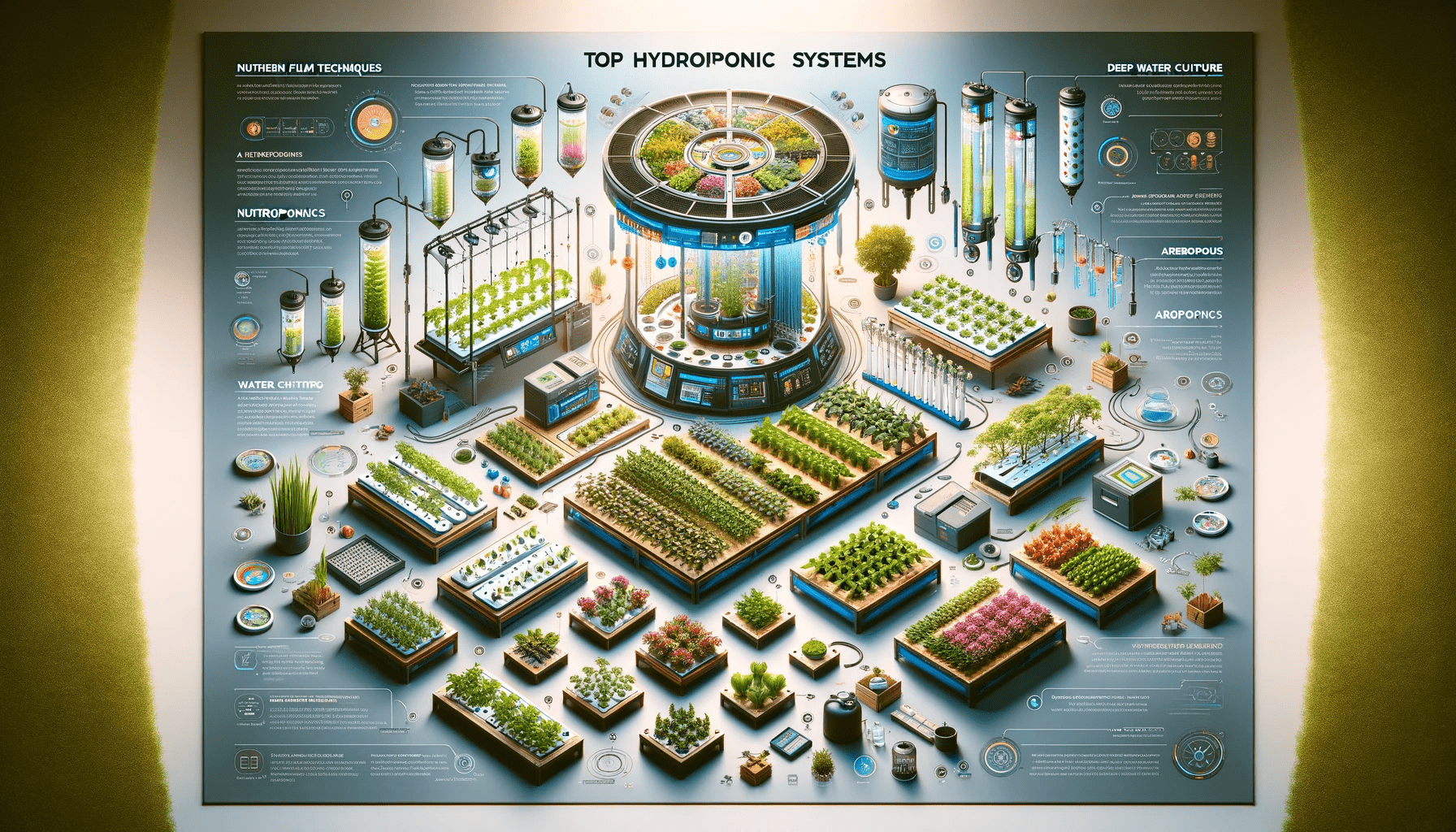

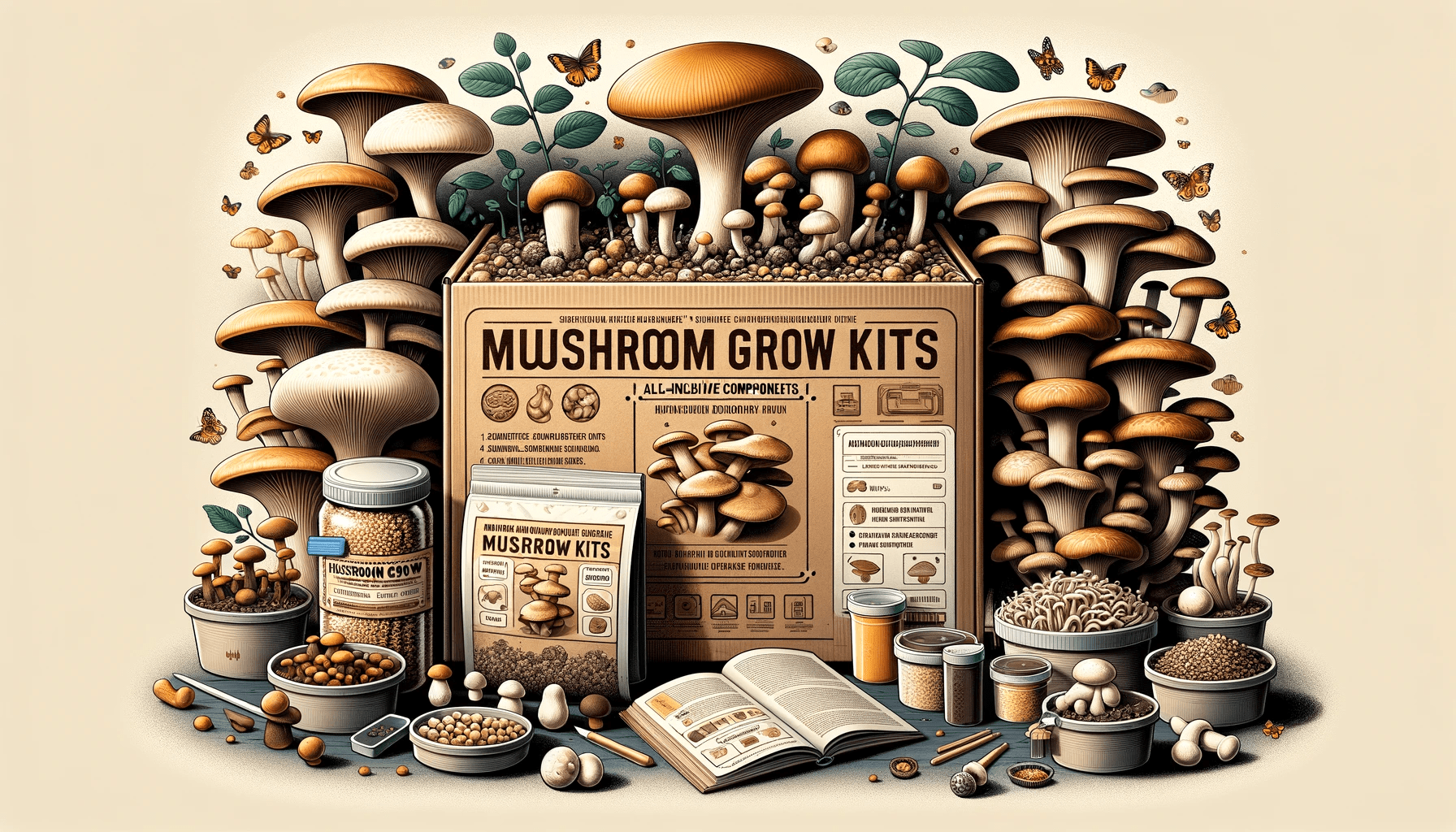

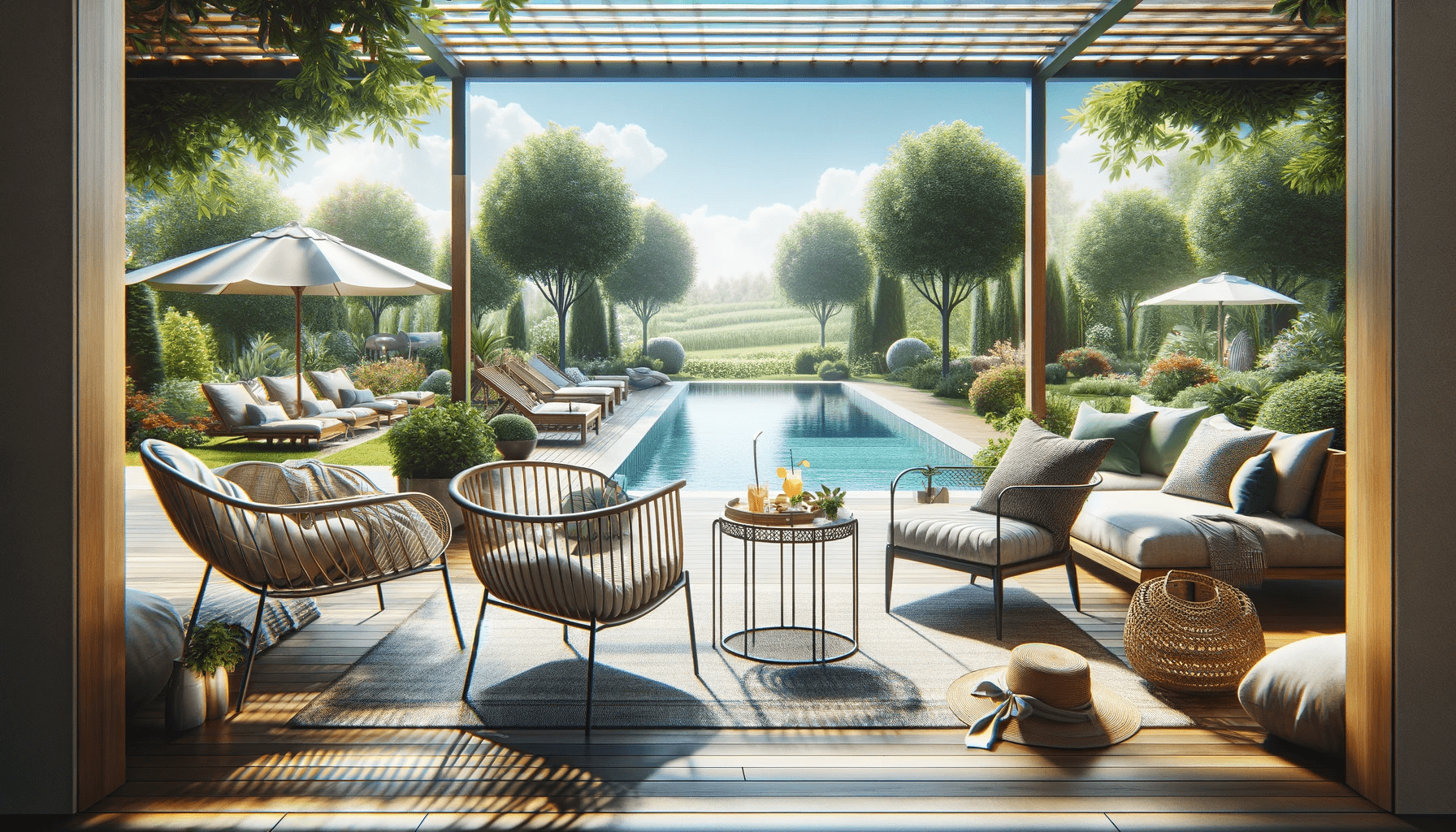

4. Outdoor Living and Gardening

Outdoor living and gardening products have seen remarkable innovation, transforming backyards and balconies into functional and stylish extensions of the home. This category includes weather-resistant furniture, portable gardening kits, and outdoor cooking appliances, enhancing outdoor living experiences and connecting homeowners with nature.

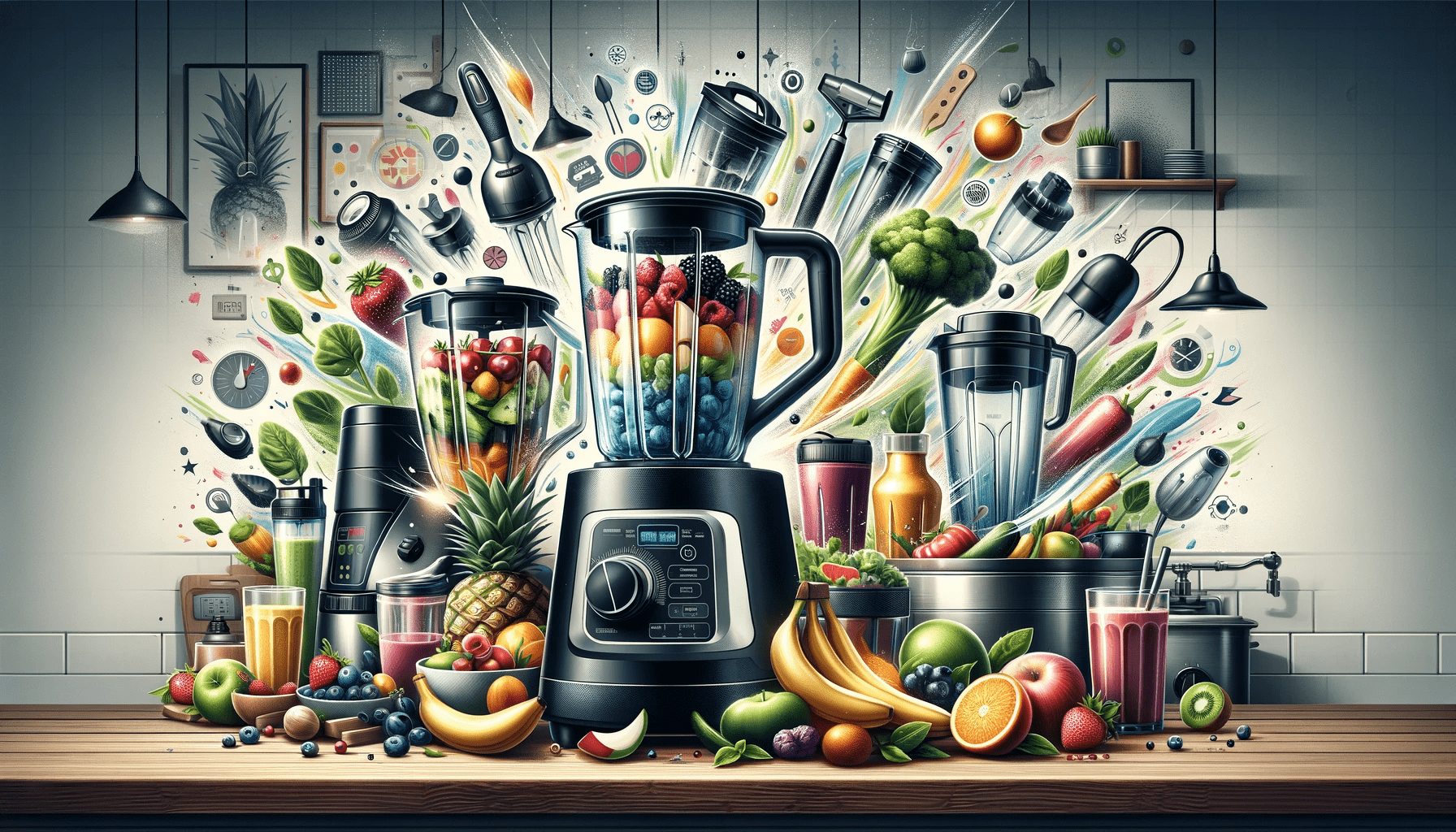

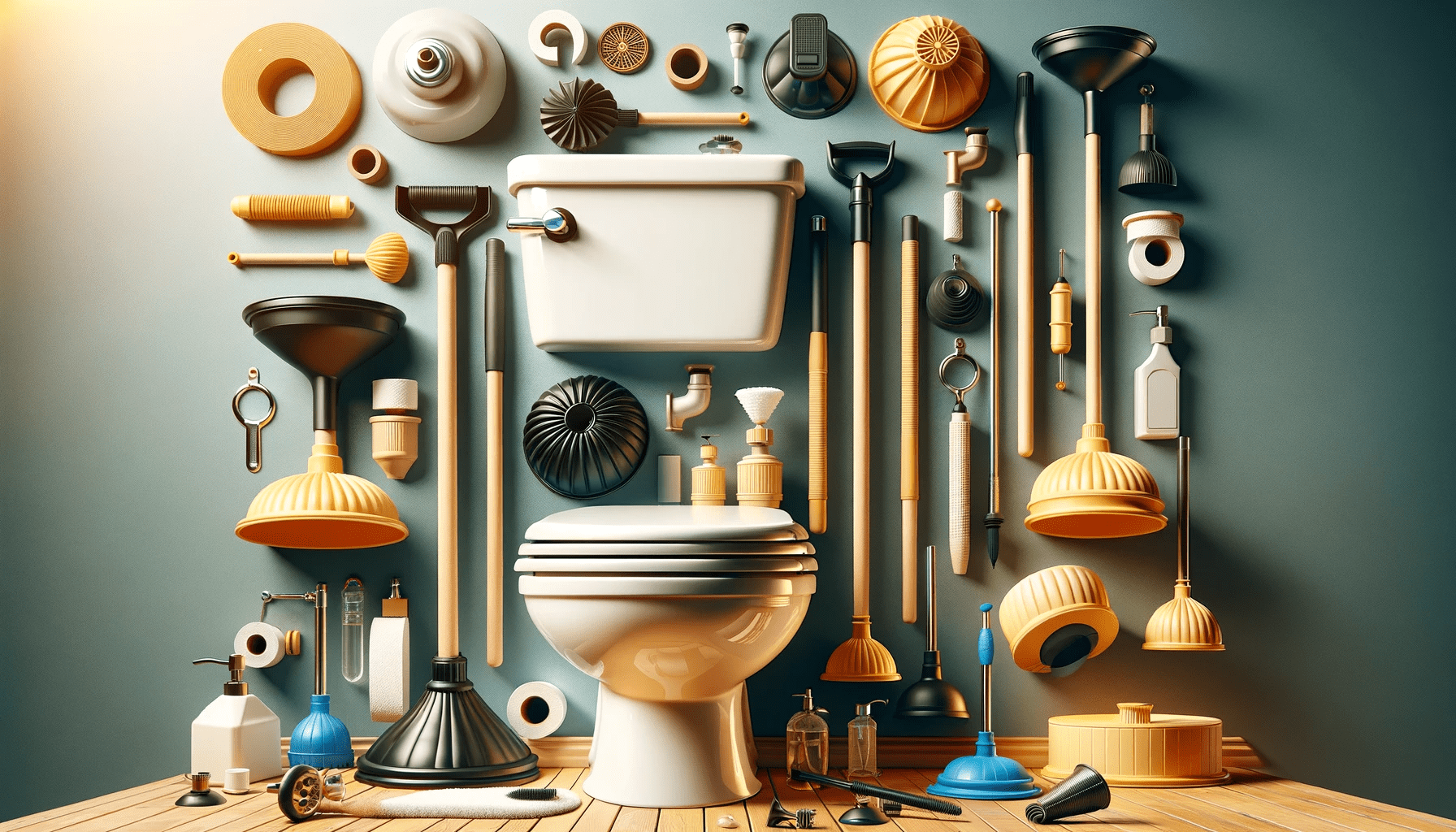

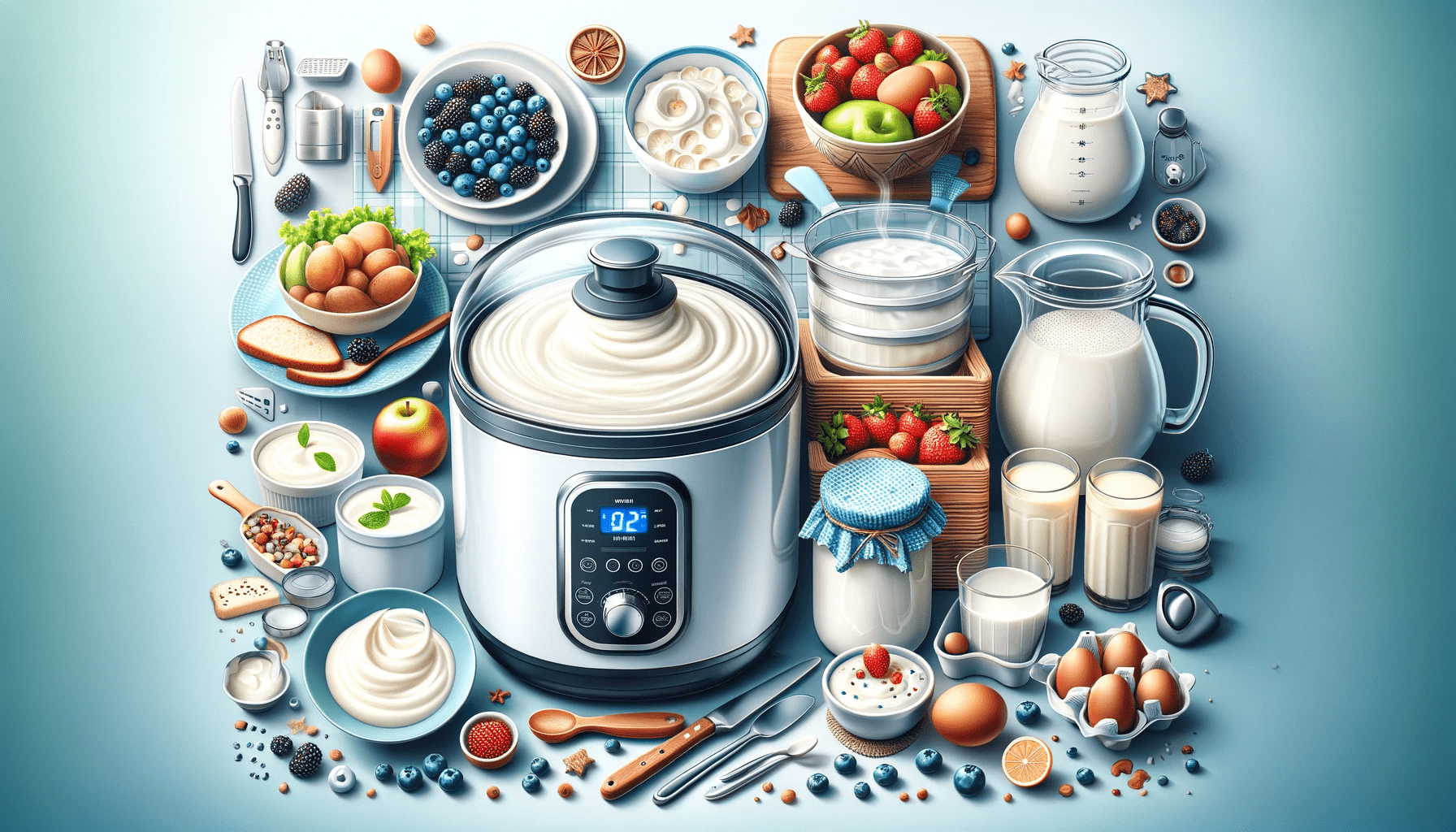

5. Kitchen and Cooking Innovations

Kitchen and cooking innovations continue to evolve, with products aimed at simplifying food preparation and enhancing the culinary experience. This includes smart kitchen appliances, sustainable cookware, and multifunctional gadgets that combine high performance with time-saving features, appealing to both seasoned chefs and casual cooks.

Our Review Methodology

To provide our readers with accurate, reliable recommendations on the top trending home products of 2024, we`'ve developed a comprehensive review methodology that encompasses the following key components:

A. Product Testing and EvaluationWe rigorously test each product for functionality, durability, and user-friendliness, assessing how well it performs in real-world settings. This hands-on approach allows us to identify the strengths and weaknesses of each product, ensuring our reviews are grounded in actual usage experiences.

B. Consumer Feedback and RatingsUnderstanding that real consumer experiences offer invaluable insights, we analyze customer reviews and ratings across multiple platforms. This feedback helps us gauge overall satisfaction, reliability, and the long-term value of products.

C. Expert ConsultationWe consult with industry experts and professionals to gain deeper insights into the technical aspects and innovation behind each product. This collaboration enables us to understand the cutting-edge features and how they benefit consumers.

D. Sustainability and Ethical PracticesIn line with the growing demand for eco-friendly products, we evaluate the sustainability of each item, including materials used, manufacturing processes, and the company`'s commitment to environmental and social responsibility.

E. Value for MoneyWe consider the cost relative to the features, durability, and overall performance of the product, ensuring our recommendations offer great value for money. This holistic approach ensures that our readers are well-informed to make purchasing decisions that align with their needs, values, and lifestyle.